This month, Bitcoin went on a bull run that harkened memories of 2017 when digital currencies routinely reached new peaks before pushing seemingly ever higher.

While everyone remembers the peaks, it’s easy to forget about the valleys. The price decreases that often accompany Bitcoin’s price ascendance. Volatility is the less exciting component of the digital token’s ascendance from niche obscurity to global popularity, and it was present once again in Bitcoin’s latest run.

After breaching the 8,000 thresholds for the first time since last summer, Bitcoin took a steep fall, dropping to almost $7,000, proving once again that volatility plays a prominent role in the token’s wild rise to maturity.

Of course, volatility isn’t just a Bitcoin problem. Many of the most popular digital tokens are plagued by rapid price escalations and wild devaluations, something that makes them veritably unusable as currency and relegating them to the role of speculative assets.

For many in the industry, the solution to this volatility has been stablecoins. Using the same technology as other cryptocurrencies, these tokens align their value with tangible assets like fiat dollars, metals, or other resources. They are a popular way to hedge against the volatility of the crypto ecosystem, and their functionality could significantly outpace their more erratic counterparts.

In effect, they retain the security, functionality, and usability of digital currencies while offering the price reliability of more established assets.

It’s a good solution, but the industry certainly isn’t perfect. However, as its most pressing problems are addressed, they can enable stablecoins to represent the functional wing of the digital currency movement.

First, we need to understand the problem. Here are two shortcomings of stablecoins and what it means for the future of the sector.

Regulatory Standing

Most see regulatory uncertainty as a significant to crypto adoption at every level, but it’s an especially prescient problem for stablecoins.

Because stablecoins purport to be asset-backed in some capacity, they carry the weight of a promise, which could classify the tokens as securities. As Valerie Szczepanik, the SEC’s senior adviser for digital assets, told a crowd at SXSW, “It’s these kinds of projects where there is one central party controlling the price fluctuation over time that might be getting into the land of securities.”

In March, SEC Chairman Jay Clayton announced that the agency deemed that Ether and other similar tokens are not securities. In an earlier letter, Chairman Clayton noted the fluctuating definition of a security as it applies to the cryptocurrency movement.

While this brought considerable clarity to the issue for platforms like Ethereum, stablecoins are still waiting for regulatory oversight that could define the industry’s development going forward.

More specifically, regulations regarding asset verification, company communication, and other standards could pave the way for stablecoin platforms to position themselves for mainstream, regulated integration into the financial and commerce ecosystem.

Bad PR

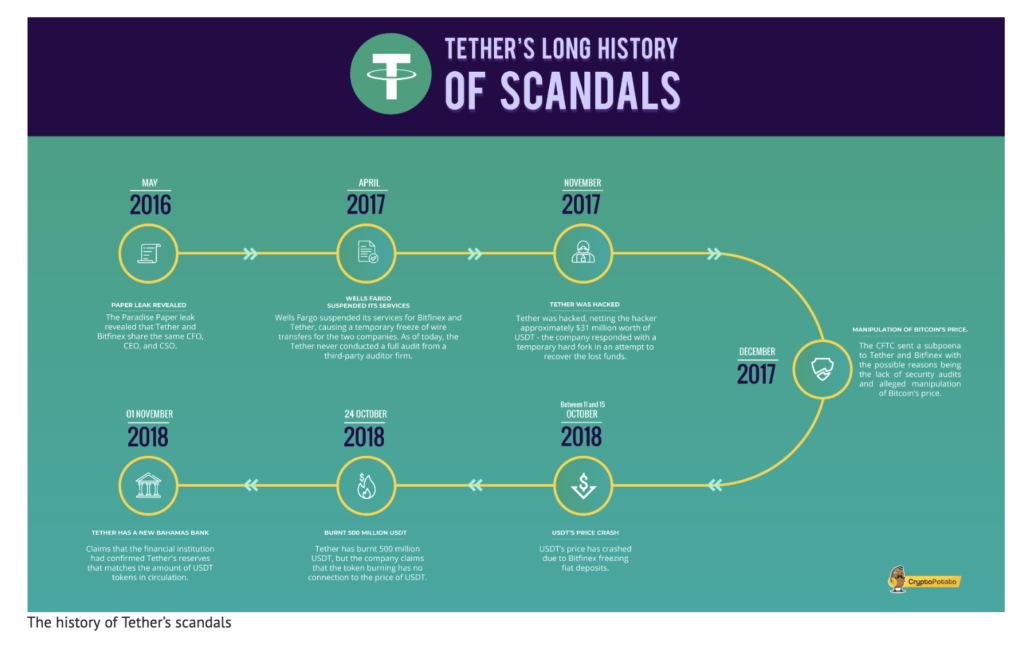

Unfortunately, the most well-known stablecoin, Tether, is continually embroiled in controversy.

At one time, the token purported to hold $1 in its bank account for every token that the platform issued. Critics were often incredulous of this claim, and their suspicions were confirmed this year when Tether updated its website.

“Every tether is always 100% backed by our reserves, which include traditional currency and cash equivalents and, from time to time, may include other assets and receivables from loans made by Tether to third parties, which may include affiliated entities,” the company’s website explains.

Most recently, Tether and the crypto exchange Bitfinex, which are owned by the same parent company, colluded to cover up an $850 million loss from the exchange.

Stablecoins are meant to elicit trust from their users, and their biggest ambassador has repeatedly failed to promote that priority to a global audience.

However, as Forbes concluded after Tether’s most recent debacle, “despite these legitimate concerns about Tether’s operations, the value proposition of its business model is strong.”

In other words, Tether’s platform may have opened the door for other platforms to present more usable and trustworthy forms of the stablecoin premise. There is certainly a demand for such a product.

What Will the Future Hold?

Clearly, there is a growing demand not only for digital currencies in general but for stablecoins in particular. Tether boasts a market cap of nearly $3 billion, and its stable measure of value makes it a popular go-between for crypto transactions.

While it has been relatively immune from the consequences of its bad actions in the past, there is no promise that it will maintain its standing as the most prominent stablecoin. Instead, there is an opportunity for these tokens to promote the future of finance and commerce by creating highly usable, fully auditable, and widely available stablecoins.

In a digital era that already makes the majority of its transactions online, the use of a highly flexible and unquestionably reliable digital currency seems like the perfect fit for out moment.

Stablecoins have their share of problems, but there are ready solutions that, if properly embraced, could go a long way toward propelling the sector forward.

42