T he IMF? SDR? What in the world are you talking about, Xank team. What does this have to do with blockchain, or Xank, for that matter. Well, remember Xank’s Stable Pay? The IMF’s SDR is an integral part of Xank’s Stable Pay function. Let’s go ahead and talk about the IMF and SDR and discuss why we chose the SDR as the standard for Xank’s price calibration for stable transactions.

What is the IMF?

The IMF, or International Monetary Fund, is an international organization for global monetary cooperation and financial stability. Established in 1944, the IMF’s main purpose is to make sure that the international monetary system is kept stable. We’re talking about exchange rates and international payments that help countries transact with one another. The IMF helped alleviate the financial instability of the Asian Financial Crisis of the late nineties by providing loans to suffering nations and has been active in many ways since its creation. With 189 member countries, 1 trillion dollars available for loans, and a 0% interest rate on loans granted to low-income countries, the IMF continues to pursue its objective of international monetary cooperation and stability.

Among the IMF’s cool features is something called the SDR.

What is SDR?

The SDR, or Special Drawing Right, is a foreign-exchange reserve asset that supplements IMF member countries’ reserves. The SDR itself is not a currency, but rather a potential claim on member countries’ currencies. So far, about SDR 204 billion have been allocated to countries. Okay, but how much is this SDR worth?

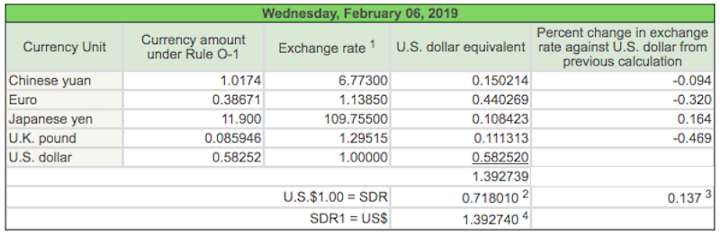

The SDR’s value is derived from a basket of currencies, which are the U.S. dollar, the euro, the Chinese renminbi, the Japanese yen, and the British pound sterling. While these five major currencies are all part of the basket, each currency carries a different weight.

You can check the value of SDR in terms of the U.S. dollar on the IMF’s website, which is updated daily at noon, London time. The value of the SDR is calculated by adding the value of the five currencies (in U.S. dollars) based on market exchange rates.

Why did Xank Choose the IMF’s SDR?

You may be wondering, why did Xank elect to go with the SDR over “normal” currencies like the U.S. dollar or euro? The reason is simple. Xank’s Stable Pay intends to ensure that a transaction retains a fiat value in terms of the most stable asset. After sifting through various options, we at Xank came to the following conclusion: the SDR, as a bundle of currencies, is far more stable than a single currency and is more resistant to manipulation by a single country. At this point in time, the Xank team believes the IMF’s SDR to be the most stable international reserve asset, which renders it most appropriate for Xank’s Stable Pay calibrations.

The Xank blockchain will employ an oracle service to receive real-time data of the SDR rate. Masternodes will be responsible for proper operation of these feeds, and safeguard mechanisms will be put into place to prevent any interruptions or attacks on the oracle system. (You can read more about our solutions to potential problems in pages 22 to 23 of our whitepaper.)

We wish to provide you with the best Stable Pay functionality hand-in-hand with the world’s most stable asset, the IMF’s SDR. Once the Xank network is live, we’ll see the SDR in action as you enable Xank’s Stable Pay feature for your transactions.