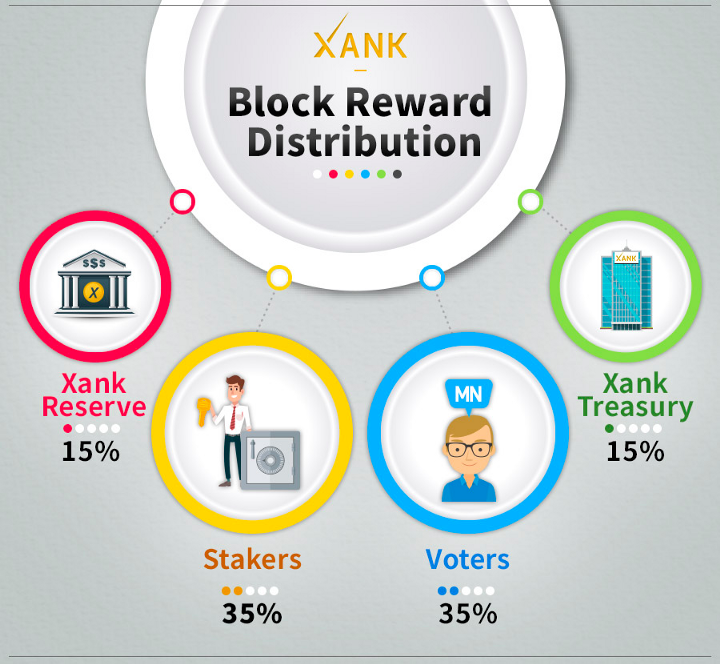

W hen Xank’s blockchain goes live, blocks will be produced on Xank’s very own main net, which will implement a proof-of-stake consensus algorithm (you can read more about Xank’s consensus mechanism here). But today, we’re not here to talk about Xank’s proof-of-stake algorithm. We’re here to show you how the block rewards, the sweet fruits of block production, will be distributed after the creation of a new block.

Xank Reserve

15% of the total block rewards go to the Xank Reserve. Now what is the Xank Reserve and why is a substantial portion of block rewards allocated to the Xank Reserve? Let’s tackle both these questions one by one.

The Xank Reserve is Xank’s autonomous reserve fund that serves as a stabilizing mechanism. When Stable Pay is activated, transactions are fixed at a certain fiat value (the Xank-SDR value), and to ensure the fiat value is retained, the Xank Reserve will calibrate the value of Xank coins against the value of the SDR. The Xank Reserve must hold a portion of Xank coins in order to carry out its purpose as an autonomous calibrating mechanism, thus the block reward allocation.

Stakers

Stakers receive 35% of all block rewards. Stakers are those who hold any positive amount of Xank in their wallet and contribute to the validation of transactions and help maintain the ledger on Xank’s blockchain. Stakers will receive block rewards in proportion to the amount of Xank coins they hold. The best part is anyone, even someone with 1 Xank coin, can stake their coins to not only help the network but also win a piece of the pie!

Voters

Voters, also known as masternode operators, receive 35% of the total block rewards. Voters are essentially stakers who have put up a larger stake — a minimum of 1,000 Xank coins — for the stability of the network. They are not only entitled to a 35% share of the block rewards, but they can also participate in voting for network proposals. Although more masternodes does not grant more voting power, more masternodes do give as an individual more reward.

Xank Treasury

The final 15% of block rewards go to the Xank Treasury, Xank’s self-funding mechanism for network growth and development. The Treasury basically stores Xank coins that will be used for a bunch of things, including code development and auditing, marketing, translating of essential documents, projects approved by voters, and other needs as outlined in the Xank Constitution. Because all these tasks require money, Xank’s Treasury safely holds onto Xank coins until they are approved for spending.

We’ve outlined Xank’s block reward system in our story today. The advantage of Xank’s block reward structure is twofold. First, network participants are rightly rewarded for the upkeep of the Xank blockchain. Stakers and masternode operators alike are compensated for their contribution. Second, the Xank Reserve and Xank Treasury are fully and aptly funded to ensure they fulfill their respective duties within the Xank protocol.

Xank has achieved a fair balance of rewarding network participants while funding the system and all its needs. Check out our white paper to learn more about how this all works.