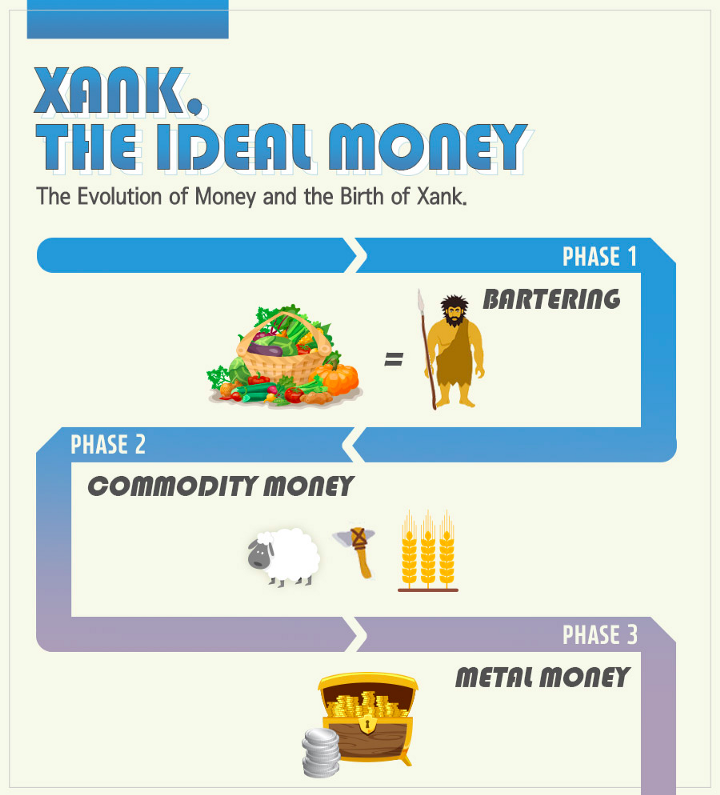

M oney, like all other things, has undergone a subtle yet steady transformation throughout several millennia and is still evolving today. Today, we’re going to talk about the evolution of money and introduce to you Xank, the ideal money. Boring, you say? We’ll keep you entertained with a visually stimulating infographic that will better explain the history of money. Stay with us — you won’t regret it!

Phase 1 — Bartering

When our ancestors lived by hunting and gathering, there was no such thing as money. In fact, private properties and market economies were completely alien concepts. At that time, people traded their goods for someone else’s goods or services. For example, I could pay someone a basket of fruit in return for their hunting service. The concept of ‘bartering’ between individuals and tribes was merely exchanging favors, and the system was maintained by the spirit of cooperation, which stemmed from good faith and trust.

The problem:

Eventually, civilizations evolved and grew to produce various commodities that would be used as a medium of exchange, rendering the barter system antiquated and unfeasible.

Phase 2 — Commodity Money

Soon, the agricultural revolution began, and things began to change. As cities developed, so did the social infrastructure. Then, so-called ‘experts’ like blacksmiths, weavers, and butchers began to emerge. This led to specialization where people concentrated on producing a particular good or service. The goods that were created served as money for the people.

The problem:

If my commodity was undesired, there was no demand, meaning there was no way for certain individuals to buy other goods. Also, people had different opinions on how much good was worth, so the consensus was an issue.

Phase 3 — Metal Money

The existing exchange system was an inconvenient negotiation process due to different opinions on the value of goods and services. People sought for rules and guidelines for efficient exchange, and eventually, this led to the birth of money.

People chose metal money as a replacement for the commodity money system. Metal carried to some degree the characteristics of what we define as money: durability, portability, divisibility, uniformity, and acceptability. Pieces of gold, silver, and other metals functioned as money, and with time, rough fragments of metal were molded into metal coins.

Meanwhile, with the advent of metal money, productivity increased through specialization and the division of labor, which led to economic growth.

The problem:

People had to spend a lot of time and energy weighing metals for each transaction, and the physical burden of carrying this metal money around was too much for the people. Moreover, counterfeit metal coins surfaced.

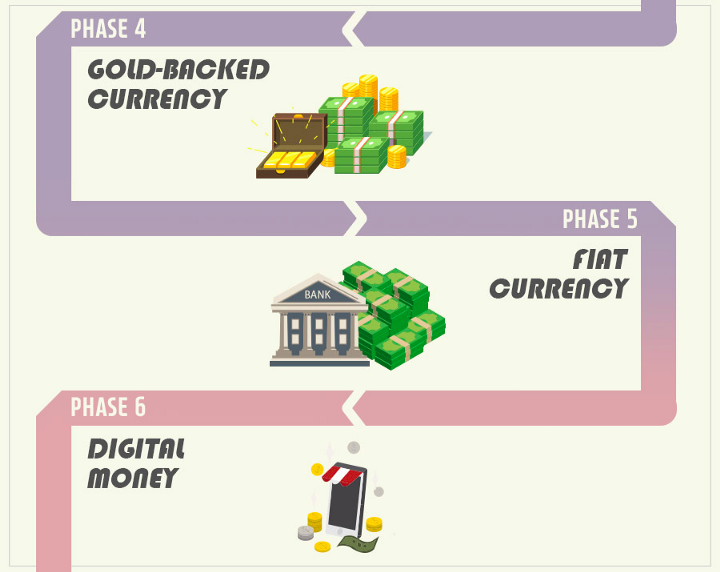

Phase 4 — Gold-backed Currency

The problem of counterfeiting metal coins resulted in issuing authorities losing their credibility. Consequently, the authorities were prompted to issue convertible notes that came with the promise that the notes could be converted into a certain amount of gold. Thus arose the famous ‘standard system’.

From heavy metals, mankind moved on to paper money that was backed by gold. Notes that were convertible into real gold were issued. Because money was now backed by gold, it maintained its value in gold.

The problem:

Because there was no central entity, confusion ensued as private banks were established here and there. In England, the government eventually prevented private banks from issuing their own notes. Here we experience signs of centralization.

Phase 5 — Fiat Currency

With the gold standard gone, fiat currency was introduced to the world. A fiat currency’s value is backed by the government that issues the currency. In other words, the government declares the currency to be legal tender, and the value of this money is determined by supply and demand. Fiat currency is the money we widely use today.

The problem:

The central bank has the authority to print money whenever it pleases, and the printing of money can lead to hyperinflation, as we saw in Venezuela this year. In addition to central banks’ seemingly unchecked power, commercial banks that serve the public were formed. While the services provided by these banks are useful, commercial banks have created a money system of unnecessary transaction fees, transfer delays, and vulnerability to attacks.

Phase 6 — Digital Money

Digital money is fiat money that is available electronically. Digital money can be transferred online via the Internet to allow for efficient transactions between parties.

The problem:

Digital money shares the flaws of fiat money. Since digital money is fiat money in digital form, it carries the same inherent problems.

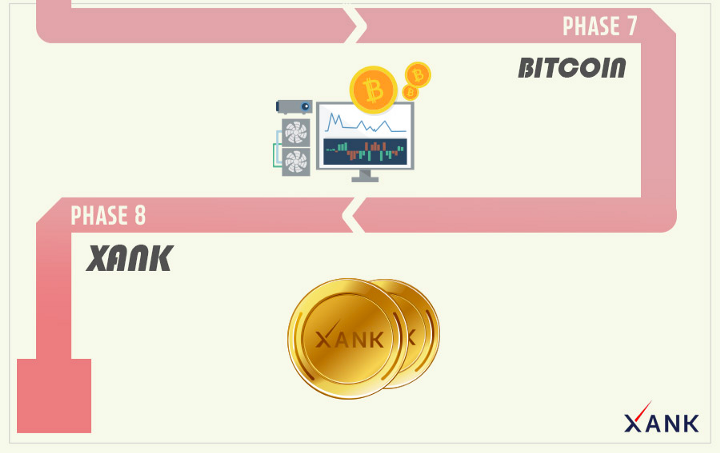

Phase 7 — Bitcoin

The inefficiency and centralized nature of fiat currencies led to the birth of Bitcoin in 2008. Bitcoin’s goal was to serve as a decentralized currency. As the first of all cryptocurrencies, Bitcoin opened our eyes to the possibility of a decentralized, scalable, stable, and private currency and other cryptocurrencies have emerged in an attempt to be the one true solution.

The problem:

Bitcoin was a revolutionary invention, but it did not possess the attributes of a currency that could replace fiat currency. Other cryptocurrencies have tried as well, but none has succeeded in doing so.

Phase 8 — Xank

Xank, “The Ideal Money”, is a cryptocurrency that has the potential to function as money for all people. Let’s explore Xank.

Xank exhibits stability in price (Xank is a free-floating cryptocurrency with stablecoin functionality — we’ll get to that later), scalability, privacy, and decentralization. Because Xank is decentralized, so no central authority can alter the money supply in the way central banks do. Xank solves the problems of cost and time inefficiencies that we witness in the current money system and also holds investment value as a cryptocurrency. Xank is the ideal money, and you will be introduced to the delicate details of this money of the future.

The Birth and Future of Xank

We created Xank to better serve the needs and wants of all humanity. It has been brought into the world to solve current problems like inefficiency and inconvenience, but we are aware that change will take time. As the cliche goes, “Rome wasn’t built in a day”.

As the world slowly evolves, currencies evolve as well. Let’s go over what we just learned. Metals eventually replaced commodities like rice. But we must keep in mind that people did not one day wake up and collectively agree to abandon the commodity money system. Instead, the opposite happened. People insisted on the continued use of rice out of fear of change. Nevertheless, persistent efforts from both the private and public sector were able to improve the world through the adoption of novel, upgraded financial systems.

Xank is the next evolution of money. We may face a similar resistance at first, but we plan to work persistently to usher all people into a new era of Xank, an era of the ideal money.