Financial inclusion has always been a concern for some, but the recent explosion of cryptocurrencies has turned our attention to the unbanked – at a global scale. We often hear about the unfortunate plight of the unbanked, how they are unable to access financial services, but who are these people of whom we so frequently speak? Today, we want to focus on the financially excluded – who they are and how cryptocurrencies can help them discover new financial opportunities.

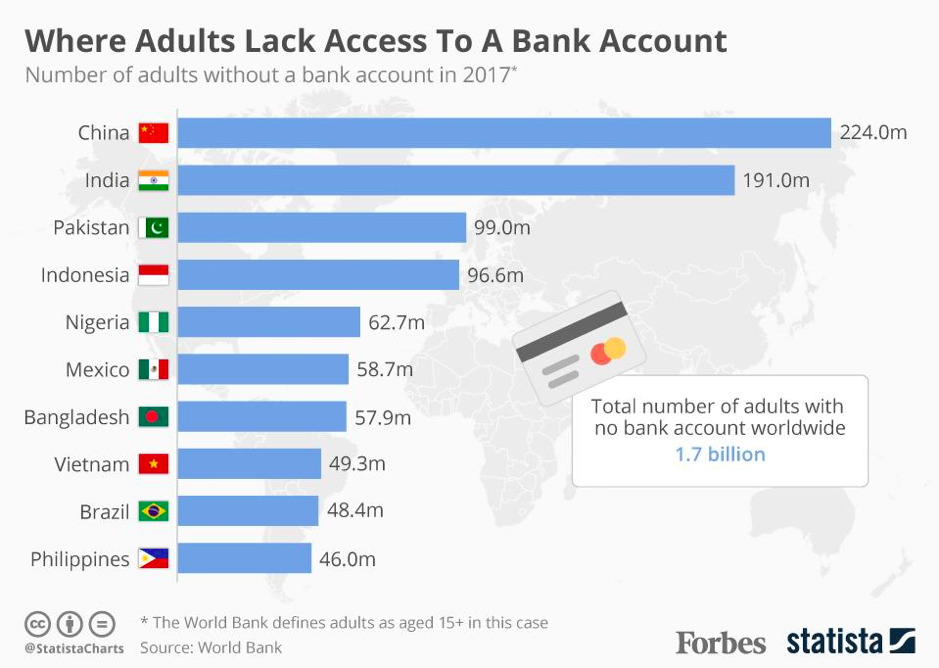

An unbanked person is someone who does not “have an account at a formal financial institution,” the most common institution being banks. According to The World Bank, while 69% of all adults in the world have some kind of bank or mobile money account, a staggering 1.7 billion adults remain unbanked. China is home to the highest unbanked population, where 224 million adults live their daily lives without a financial account. India follows closely behind with an unbanked population of 191 million, and millions in countries like Pakistan, Indonesia, Nigeria, and Brazil also lack adequate financial solutions. Most of us living in developed countries may not fully comprehend the severity of the unbanked crisis due to how easy it is for us to open up a bank account, swipe our credit or debit cards at the local 7/11, or collect cash from an ATM that operates 24 hours a day, 7 days a week. It is hard to imagine life without complete financial inclusion. While the situation is alarming, efforts have been made to ameliorate this transnational crisis.

Mobile Money on the Rise

While the problem lingers, mobile money has invited millions of formerly unbanked people to a world of digital finance, substantially mitigating the burdens of financial exclusion for many. For example, mobile banking services like M-Pesa let people hold, spend, and transfer money through their mobile devices. Launched in Kenya in 2007, M-Pesa has drastically improved the lives of many people, and similar services have sprung up in other parts of the world. Now, people can stress less about carrying handfuls of cash and keeping track of their holdings. Theft and robbery have been well-combated with the use of SIM cards in phones for monetary transactions instead of buckets of cash, which are more likely to be stolen. People are now experiencing digital payments with the press of a button on their phones.

There is no doubt that mobile money services have had a positive impact on people, and it seems as though they will continue to serve the people well. Then why is cryptocurrency required when mobile money programs are thriving and reshaping the landscape?

1. Mobile Money is Still Centralized

For an unbanked person, centralization or decentralization may be of no concern as long as they have access to a better form of money. This may be true in the immediate sense, and it is a step forward. But mobile money is still vulnerable to the vices of private companies and governments. It is merely a reproduction of cash onto the digital, so people are at the mercy of a handful of decision-makers who decide the fate of a certain money service or value of a currency.

Take for example Venezuela, a country that has experienced firsthand the consequences of mismanagement by central leadership. According to CNN, the South American nation-state suffered from a whopping 130,060% inflation rate in 2018, rendering the Venezuelan Bolivar nearly worthless. As a result, the country’s citizens have found themselves in life-threatening situations as they are unable to purchase basic needs for survival.

Then is mobile money safe? Mobile money is essentially paper money that has migrated to a different platform. Though we cannot deny that it is a big leap forward in the evolution of money, the core of the problem remains unsolved.

2. Mobile Money is Local, Not Global

The grand reveal of Facebook’s Libra had onlookers both excited and uneasy about the social media giant’s entry into the cryptocurrency market, especially considering that Libra’s mission is to be “a simple global currency.” Putting aside the controversial Zuckerberg coin, cryptocurrencies, starting with Bitcoin, were born to enable people to transact with one another without the permission of the legacy financial system.

A universally accepted cryptocurrency like Bitcoin allows people to send money wherever, whenever, at a fraction of the cost of transferring via mobile money services like M-Pesa. Following Bitcoin’s lead, other cryptocurrencies have emerged to improve upon what people consider to be Bitcoin’s downsides. For example, stablecoins like Tether and stable transaction coins like Xank have entered the game to remove the price volatility factor that renders Bitcoin insufficient for everyday transactions. In this way, innovative cryptocurrencies are springing up in the race to claim the title as a global currency.

A currency that succeeds in gaining recognition as a global currency brings value to people in ways national currencies cannot. By transferring value through a universally recognized cryptocurrency, people are protected from the downfall of a national currency, a phenomenon we’ve repeatedly seen in countries in recent years. Furthermore, although the infrastructure for spending and converting cryptocurrencies isn’t yet fully established, in the future, there may be ample opportunity for people to perform daily activities with cryptocurrencies, cryptocurrencies that are internationally accepted and without a single point of failure.

As more unbanked folks are discovering banking for the first time through their mobile phones, we are witnessing a transition from the physical to digital. Mobile money has played a critical role in ushering in this era, but they are far from perfect. With time, cryptocurrencies may be used hand in hand with mobile money and eventually surpass their predecessor to be used as borderless, fast, and decentralized currencies.

164

Yes! Cryptocurencies are global currencies!! Thanks for Sharing