2019–2020 are shaping up to be the biggest years for Stable coins coming live

Going through a recent report from the blockchain research group Blockdata, gives you insight into how big the whole Stable coin movement has gotten in the past 18 months or so. After a successful 2018, we are looking at another robust year of growth in 2019 with more innovative projects coming online. Let’s start with with a brief introduction about stable coins for all those who don’t know much about the topic.

What are Stable coins?

A Stable coin is a cryptocurrency collateralized to the value of an underlying asset, created to solve the volatility & stability issue with the traditional cryptocurrencies. The heightened volatility in the decentralized cryptocurrencies is considered a hindrance to the widespread adoption of digital assets. The stable coins can be used to solve this problem by providing a stable means of exchange and a digital store of value, in a less volatile market environment.

Benefits of Stable Coins

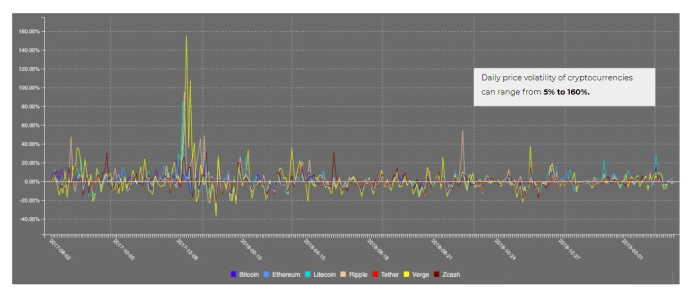

- As described before, stable coins are designed & created to minimize the price volatility in cryptocurrencies — which ranges from 5–160% as you can see in the chart above (since the beginning of 2017). These large price swings are not ideal for micropayments. The stable coins can be used for everyday transactions like fiat currencies.

- Most of the tokenized blockchain projects are conceived without any proven use cases. Therefore, the speculative nature of these digital assets makes them risky. The stable coins derive their value from the underlying assets to which they are pegged — be it a fiat currency, commodity or some other asset which are quantifiable & proven to have some value.

- Just like the central banks around the world can control the supply of the fiat currencies in an economy, some stable coin projects can control the number of digital tokens via the use of algorithms to keep the price of digital token stable, thus infusing investor confidence which in turn fuels innovation & growth.

- The stabilized, secure & scalable nature of stable coins provides a bridge between the traditional money market with the digital assets. Investors can have exposure to Crypto assets through stable coins with conviction.

- And finally stable coins can act as a Liquidity tool for the digital exchanges offering Crypto assets trading. Compared to traditional financial markets, liquidity in Crypto markets is still thin thus causing volatile price swings. These can be addressed with the use of stable coins.

Shortcomings of Stable Coins

- Financial regulators still consider stable coins as violating some of the securities laws since central parties are controlling the price movements of these digital assets.

- Most of the stable coin projects are centralized in nature which goes against the essence of the decentralized blockchain movement itself.

- Some of the Crypto & commodity backed stable coins are susceptible to increased price volatility, should a market crash occur, thus making them unstable. The grey area around the collateral behind these stable coins makes them even more ambiguous.

- Fiat backed stable coins require trust in a centralized authority like the Central banks, which are prone to destabilization & instability under the cloud of external geopolitical factors.

Charts defining the current state

The report goes on to present some of the main findings as visualized in the following charts:

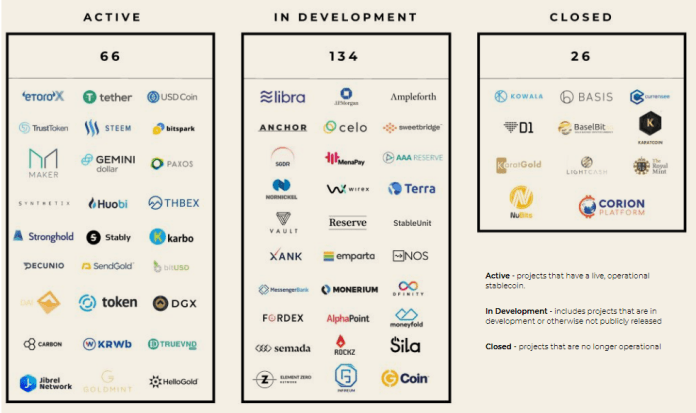

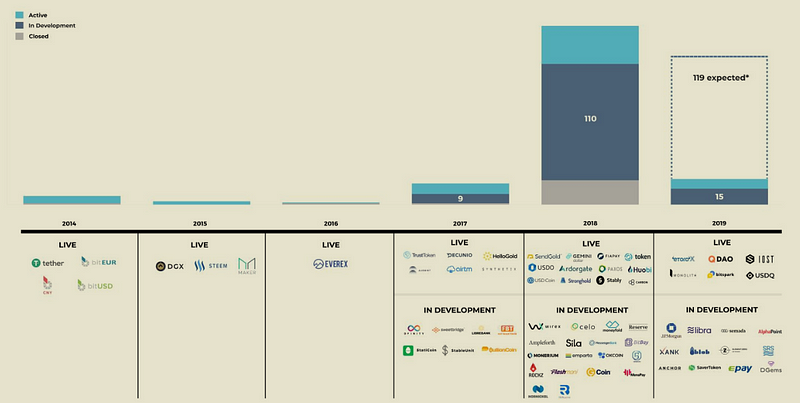

1. Only 30% of the total Stable coins are live with the rest either in development or have already closed.

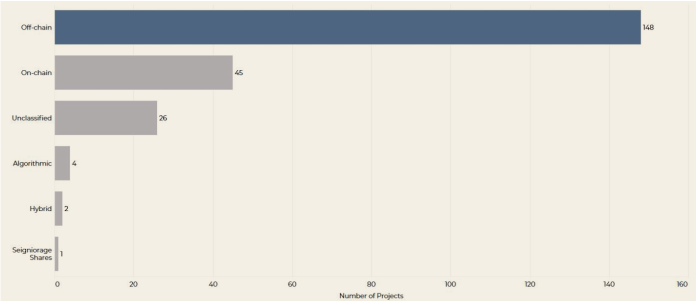

2. Off-Chain is the most popular form of collateral for stable coin projects (Fiat or Commodity backed).

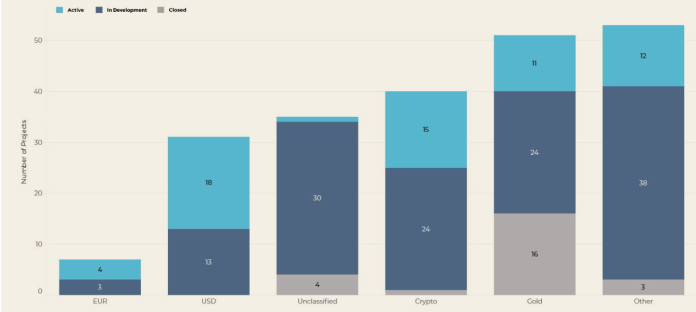

3. USD-backed stable coins are the most active & popular with the lowest failure rate, while 67% of the closed stable coins were backed by Gold.

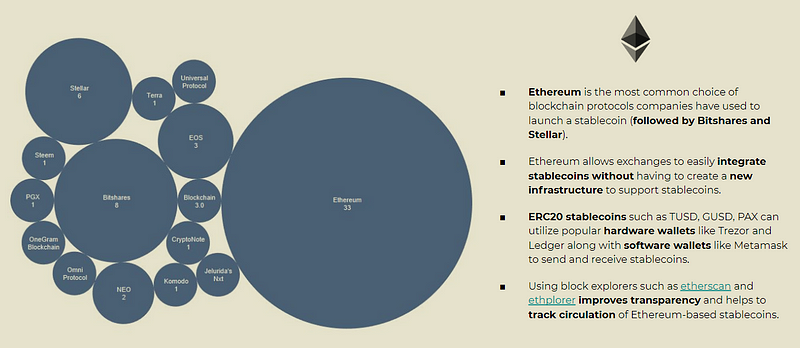

4. 50% of all active Stable coins have been developed on the Ethereum network — the most popular launching platform for these projects.

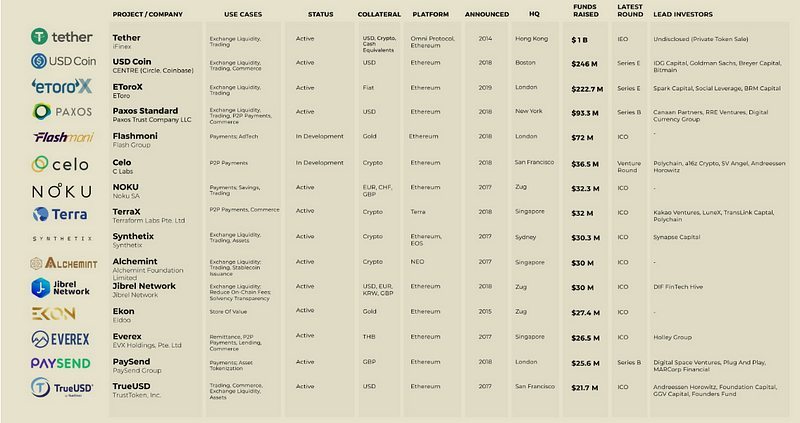

5. Tether has raised the most funding of all projects — $1 billion through an IEO, making up for half of the total $2 billion funding collected by Top 15 stable coins.

6. 2019–2020 are shaping up to be the biggest years for stable coins coming live, with 134 of them launched since the beginning to 2017 and only 15 going public so far.

If you want to read a detailed transcript of the report, you can access it here. Keep in mind though, the report is intended for educational & informative purposes only and should not be treated as professional investment advice.

The report concludes by adding two short case studies — one for the first-ever stable coin on the market, Tether, which incidentally is also the biggest stable coin. Ironically though, the project has remained mired in price manipulation & audit controversies for the most part of its existence. Nevertheless, it is still going strong. The second one concerns the high profile & ambitious decentralized project Basis — a stable cryptocurrency protocol with an algorithmic central bank. The project got embroiled in a regulatory tiff with the authorities, finally closing in Dec. 2018 after 17 months in operation.

Email?| Twitter? | LinkedIn?| StockTwits? | Telegram?

Originally Published at: www.datadriveninvestor.com

61