Blockchain Transparency Institute (BTI) analyzes Wash trading, Cleanest exchanges & True volumes of digital coins

The launch of Bakkt Bitcoin Physical futures has been a bummer for the Cryptos. At the time of writing only 71 monthly futures contracts had traded on the new platform. Not only was the slow start a little disappointing, but Bitcoin’s price plunge of about 15% within an hour on Tuesday also threw cold water on the enthusiasm of Crypto bulls.

Bitcoin temporarily dropped below the $8K level before rebounding — trading around $8400 at the time of writing. An anonymous trader reported that the selling pressure in BTC might have been exacerbated by calls and contract liquidations on Bitmex — a crypto exchange that lets clients trades with 100x leverage. These margin calls were observed by the crypto analytics platform DataMish. If this is the case, it may raise some serious questions about how a single crypto exchange can affect the price of digital coins.

Blockchain Transparency Institute (BTI) has just published its 5th market surveillance report (Sep. 2019), which it has been publishing since August 2018. The report basically clears out the wash trading volumes in Crypto exchanges using its proprietary algorithm. The company also launched the BTI Verified Program to verify accurate reporting of cryptocurrency exchange volumes.

➤ As per BTI, they have received cooperation from many exchanges and wash trading has been reduced by 35.7% ever since the beginning of 2019 (Figure 1). Detailed methodology of BTI Verified program can be found here.

➤ The latest entries to the BTI Verified Club are Binance, Gemini, Bitflyer & Indodax bringing the total verified exchanges to 13, which includes names like Coinbase, Kraken & Poloniex among others (Figure 2). The four new entrants are now reporting wash trading below 10% thus giving them a position in the Verified exchange list.

➤ The cleanest exchanges according to BTI data continue to be Kraken, Poloniex, Coinbase & Upbit. For detailed data, check out the real Top-40 exchanges.

➤ On the flip side, OKEx and Bibox report fake volumes in excess of 75%. Their real volumes, however, (after removing wash trades) still places them in the Top-20 exchanges consistently.

➤ The United States & Japan were home to some of the cleanest Crypto exchanges owing to tougher legal and regulatory standards. This, however, is not true for South Korea, where shady practices of Bithumb have escaped the tough regulatory oversight in the country.

➤ Talking about individual tokens, Bitcoin is still being wash traded at 49.20%, Ethereum 67.78%, Ripple 57.46%, Tether 63.37% & Bitcoin Cash 80.29%. Top coins like Monero & Dash were reporting fake volumes of 91.70% and 97.17% respectively. Data details for wash trading in individual digital tokens can be found here.

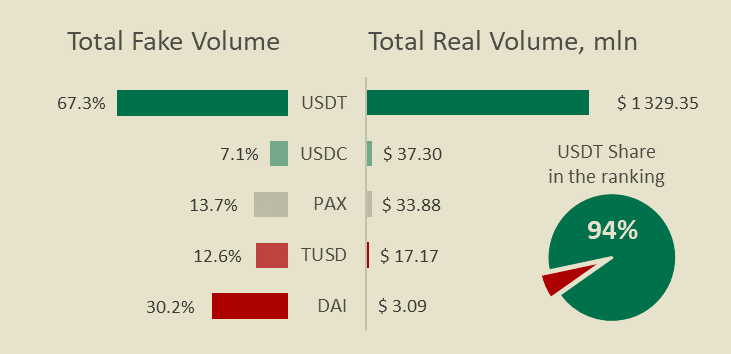

➤ The top stable coin remained Tether (USDT), accounting for 94% of all trading volume in the space after removing the wash trades which stood at 67.3% in the past 90 days (Figure 3).

➤ USDC was hogging the second spot with the honor of having the lowest global wash trading value at under just 7% in the past 90 days. DAI was the fifth largest stable coin with the second-highest wash trading of 30.2%

➤ BTI also took a jab at Coinmarketcap (CMC), that the latter’s Top-10 “Adjusted Volume” rankings include LBank, BW.com, Bit-Z, Coinbene, and OEX exchanges with fake volumes of 99.5%, 99.2%, 99.4%, 96.9%, and 99.7% respectively according to BTI analysis. BTI suggests CMC should perform stringent checks on volumes reported by different Crypto exchanges.

BTI acknowledges that more work still needs to be done to address the issue of fake volumes in the Crypto market. Wash trading is a stigma on the transparency of the Crypto market which misleads investors and should be addressed forthwith.

Originally Published on Medium.

Medium | Twitter | LinkedIn | StockTwits | Telegram

16