Each day, millions of consumers make purchases by swiping their credit cards at checkout. It’s a ubiquitous part of the modern purchasing experience, making the cash-searching customer look outdated when they use paper money at the register.

This process is so fast, simple, and convenient that it’s easy to forget that it’s relatively novel and that it comes with a cost. Businesses pay a processing fee every time their customers make a purchase with a credit card, which increases the cost of doing business in a way that negatively impacts everyone except the credit card companies receiving the fees.

To be sure, it’s a modest fee. The average company pays about 2% of the purchase total in processing fees, but that number can add up quickly.

Of course, credit cards aren’t the only option that consumers have when making purchases. If anything, they are the elder statesman in the modern purchasing movement. Today, they are joined by mobile payment platforms, p2p apps, and cryptocurrencies. The later has attracted significant attention as a uniquely pertinent addition to the payment ecosystem.

Unfortunately, the relatively low fees associated with credit card purchases are what convince many people that cryptocurrencies are not as realistic as a payment method. The argument is simple: digital currencies may be uniquely suited for our modern, digital moment, but they are too expensive to actually use at checkout.

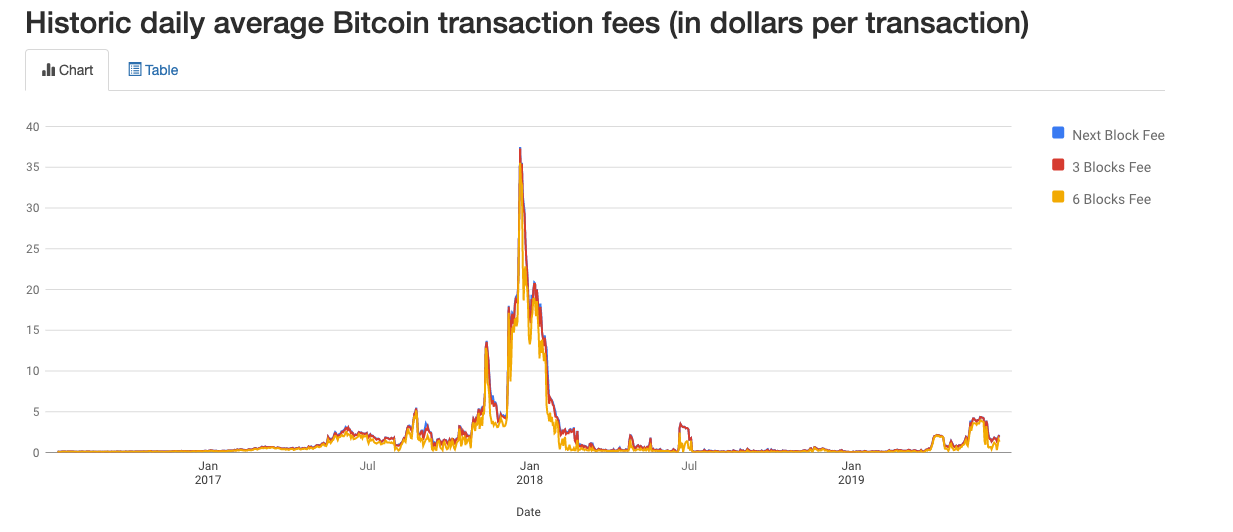

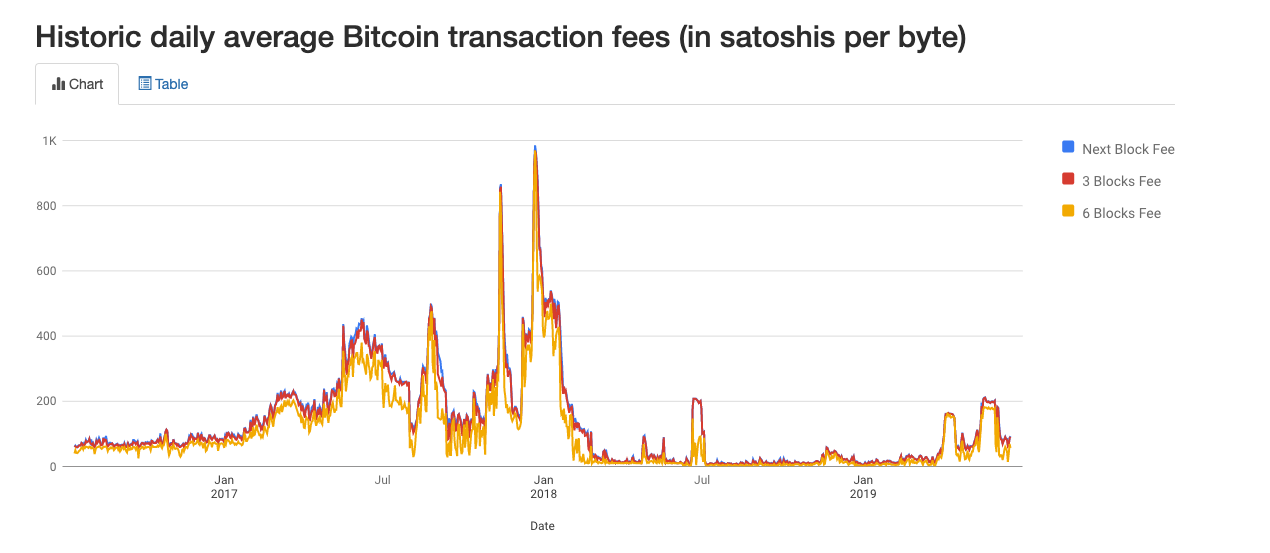

For instance, when Bitcoin peaked in price and popularity, its transaction fees were spiking as well. In 2017, those fees could exceed $38.00, a ridiculous amount to pay for the privilege of using your own money. Of course, those costs have dropped considerably since Bitcoin’s peak, and transactions fees haven’t exceeded $5 since February 2018.

An Expensive Way to Pay

Cryptocurrencies are frequently lauded for their decentralized network, which provides both better security and more profound infrastructure than its traditional, centralized counterparts.

However, this arrangement can also make crypto transactions more expensive. Since every cryptocurrency transaction must be added to the blockchain and hundreds or thousands of computers are required to maintain the blockchain that records Bitcoin transactions, the more popular a token becomes, the more expensive it is to use.

For instance, as crypto wallet providers Blockchain, explain, “Miners spend vast amounts of computing power and energy doing this for a financial reward: with every block added to the blockchain comes a bounty called a block reward, as well as all fees sent with the transactions that were confirmed and included in the block.”

With this arrangement, crypto users are inherently incentivized to hold their tokens rather than to spend them on p2p value transfers or online checkout counters.

Fortunately, these trends are changing. In fact, a cadre of stablecoins and other digital tokens are enhancing not just the usability of cryptocurrency as checkout, but they are impacting the affordability, making it cheaper to use crypto to make payments.

A More Affordable Future

Although prominent cryptocurrencies like Bitcoin continue to wrestle with a sustainable fee structure, new digital currencies are building solutions directly into their platforms.

For instance, Xank, a free-floating stablecoin that’s well-suited for making digital payments, derives its funding at the wallet level, which means that users can apply the token at checkout without fear of incurring sometimes-hefy transaction fees.

Meanwhile, TechCrunch reports that Facebook’s forthcoming digital currency will be “transferable with zero fees via Facebook products including Messenger and WhatsApp.” In this way, Facebook is deriving value from their platform’s use rather than their cryptocurrency’s transactions fees.

By altering the financing mechanism, new crypto platforms are reducing fees or eradicating them altogether, making crypto transactions even cheaper than using a credit card.

The timing couldn’t be better.

Not only do digital currencies imbue many of the privacy and security components demanded by our modern moment, but they are reflective of emerging trends at checkout.

A variety of mobile payment platforms like Apple Pay and Google Pay have already eliminated the physical credit card from the buying experience. Similar services could make it just as easy to use cryptocurrency when making a purchase online or in stores.

At the same time, retailers are seeing the benefit of accepting cryptocurrency at checkout. Prominent retailers, including Starbucks, Nordstrom, WholeFoods, and others, allow users to make purchases using cryptocurrency, something that was unthinkable just a few years ago.

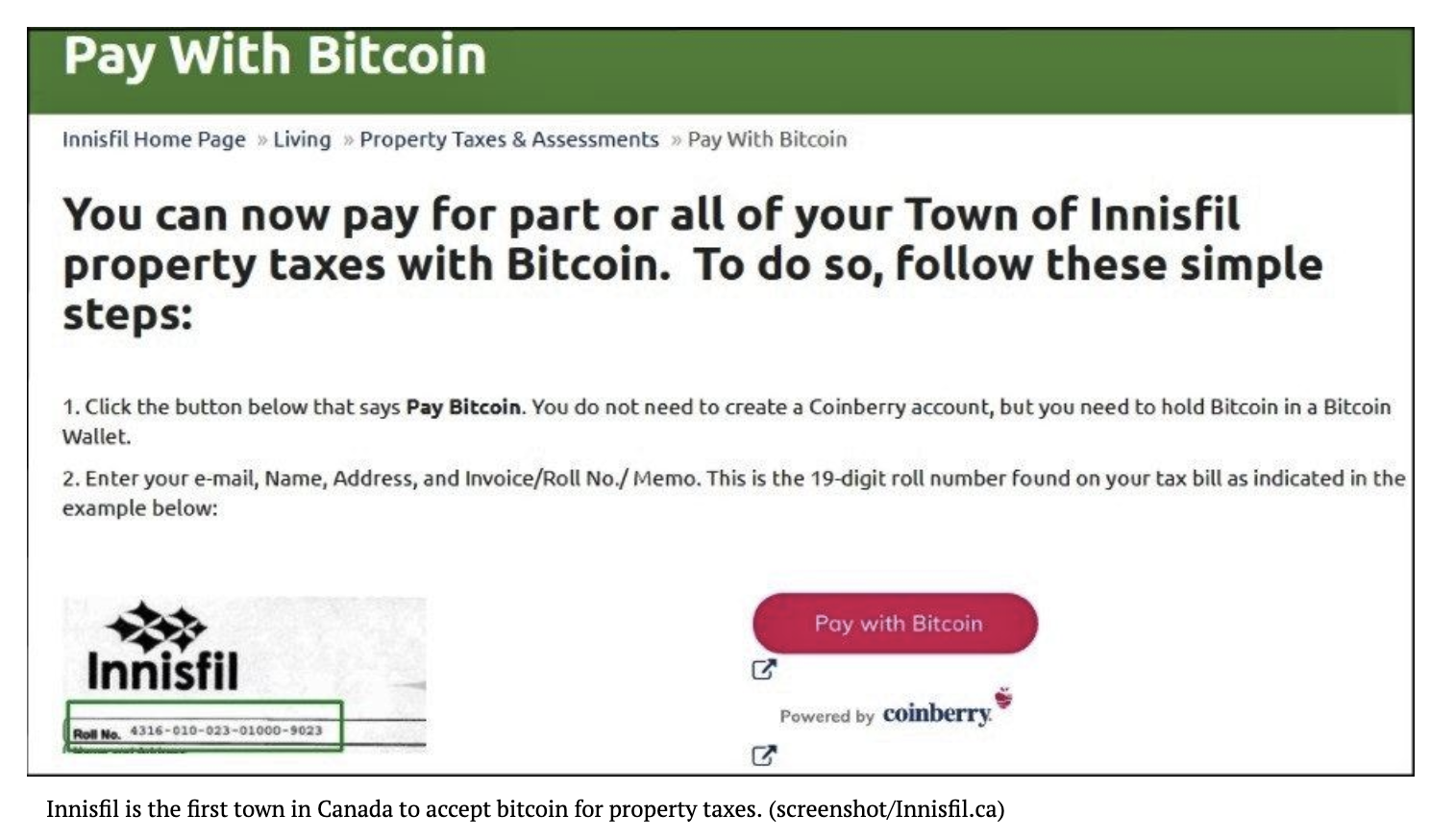

These efforts have implications that extend beyond the proverbial register. Several states in the U.S. and Canada allow residents to make payments in crypto, something that can save time and money as long as transaction fees aren’t a hindrance.

Credit cards might be an omnipresent component of today’s buying experience, but their prominence is waning. As cryptocurrencies become even cheaper than credit cards, this trend is likely to continue, and we will see more people paying for goods and services using one of the many cryptocurrencies already available and ready to facilitate commerce.

Before long, the credit card using consumer could look like the oddity, applying an outdated payment method when better, more affordable options exist.

141