5 Charts showing the state of Crypto trading & Exchanges in the Third quarter

Just as the second quarter of 2019 had provided a strong bullish momentum and a ray of hope for the crypto enthusiasts from the protracted bear run, the third quarter saw bears making the rounds with Bitcoin giving up more than half the gains from the second quarter.

BTC continued to make lower highs throughout the third quarter before a meaningful rebound from the medium-term support level of $7300 earlier today. At the time of writing, BTC was trading around $8600 with the market dominance of 66.1%.

CryptoCompare, a global cryptocurrency market data provider has recently published an Exchange review for the third quarter of 2019, providing insights into Crypto trading during the time period. Here are some of the interesting findings from the report. All charts & figures are credited to CryptoCompare.

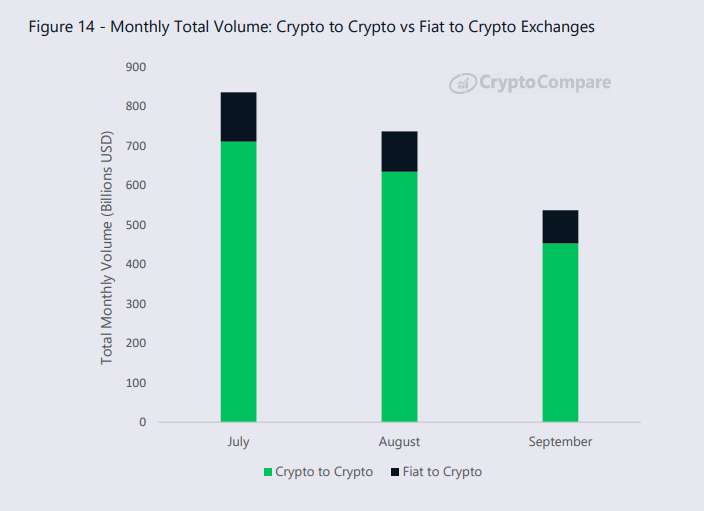

Total Monthly Crypto Trading Volume:

Crypto trading volume was as usual dominated by the Crypto to Crypto exchanges’ recording almost 84.4% (453.45 billion USD) as compared to fiat to crypto exchanges’ volume which represented 16.0% (83.93 billion USD). While the ratio of decline was consistent in all three months of the quarter, September saw a volume drop of 28.57% and 17.83% in the C-to-C & C-to-F trading respectively (Figure 1).

Institutional Trading Products & Exchanges:

Regulated derivative Products are still dominated by CME, although we may see a change in the coming months with the launch of Bakkt’s Physical Bitcoin futures & now Options launch. The total trading volume of derivative products stood at $4.82 billion in September, down 18.3% from $5.9 billion in August. Grayscale’s bitcoin trust product showed a similar declining trend for the three months of the quarter as well with a September trading volume of 713.6 million, dropping a big 37.5% from August (Figure 2).

OKEx (90.34 billion) was the top derivatives exchange followed by Huobi (84.52 billion). All derivative exchanges showed a drop in trading volume in September from August, except BitMex which recorded a slight gain of 1.6%.

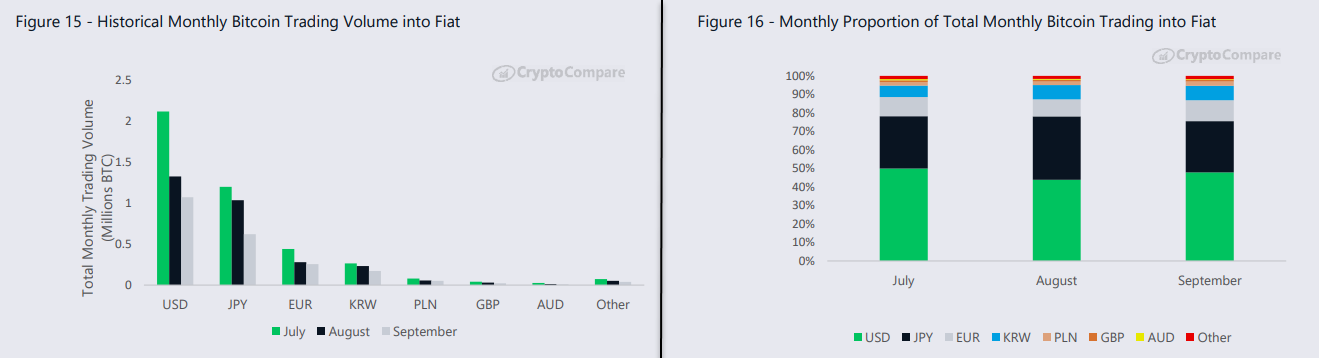

Bitcoin to Fiat Volumes:

U.S Dollar is the dominant fiat currency still when it comes to Bitcoin to Fiat trading volume followed by Japanese Yen & Euro. September recorded 47.82% of all Bitcoin trading in the U.S dollar with a volume decrease of 19% in September from the previous month — 1.07 million BTC traded in September as compared to 1.33 million BTC in August (Figure 3). BTCJPY saw a big drop of 40% (621,000 BTC) whereas BTCEUR recorded a 9% drop (255,000 BTC) in September.

Bitcoin to Stablecoin Volumes:

Tether is the predominant force in the Stable coin space representing 70.95% of trading volume against BTC, more than any other stable coin or fiat currency. USDC was the other stable coin which had a minuscule share in trading against BTC followed by the three fiat currencies USD, JPY & EUR (Figure 4). BTC trading against USDT totaled 6.22 million BTC (down 21.29% from August). The trading volume decline of BTC against other fiats or stable coins was consistent in all pairs for the quarter.

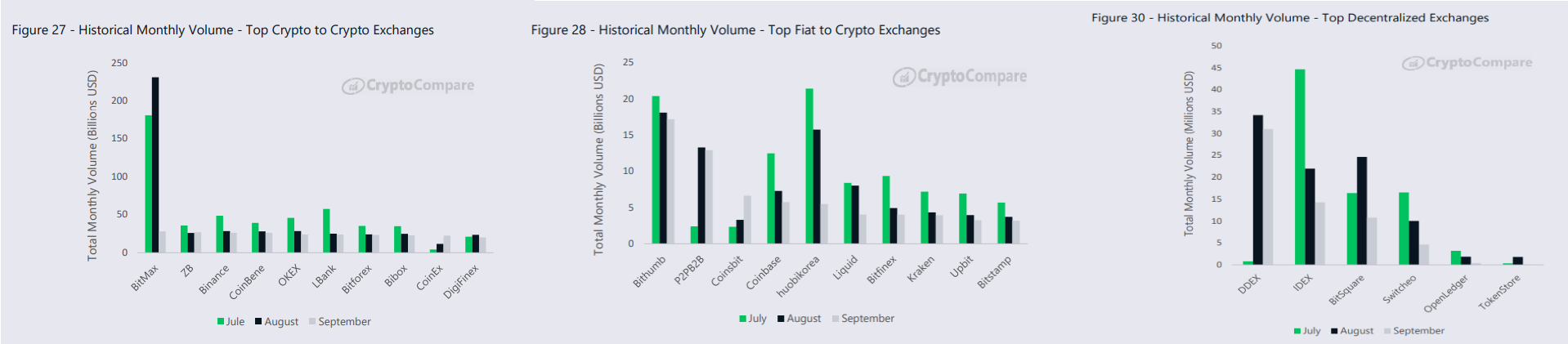

Top Exchanges by Volume:

BitMax was the top crypto to crypto exchange with an unusual spike in August before a massive decline of 87.8% in September ($28 billion) from August volume. It was followed by ZB and Binance with trading volumes of 26.9 billion USD and 26.19 billion USD, down 4.26% & 7.9% respectively.

Bithumb was the top fiat to crypto exchange with a total volume of 17.17 billion followed by P2PB2B and Coinsbit at $12.89 billion & 6.64 billion respectively. Binance & P2PB2 recorded declines of 5.02% and 2.92% respectively in September whereas Coinsbit’s volume spiked up 101.38%.

DDEX was the largest DEX with a trading volume of $30.98 million. IDEX and BitSquare were the other two major players with trading volumes of $14.28 million and $10.78 million. All three exchanges recorded losses in trading volume in September. Keep in mind that DEXs represent only 0.01% of the global spot exchange volume with a total figure of 61.17 million in September.

Originally Published on Medium.

Medium | Twitter | LinkedIn | StockTwits | Telegram

234

Hello! @Faisal Khan, really great article, thanks for sharing!

good with statistics!!