5 Charts showing the state of Crypto trading & Exchanges in the second quarter

Second-quarter for 2019 started off with a bullish momentum pulling the general crypto market out of the cold depths of the ‘Crypto Winter.’ While the gains in Alt. coins have waned since then, Bitcoin has temporarily stabilized creating a support base around the $9,000 mark.

CryptoCompare, a global cryptocurrency market data provider has recently published an Exchange review for the second quarter of 2019, providing insights into Crypto trading during the time period. Here are some of the interesting findings from the report. All charts & figures are credited to CryptoCompare.

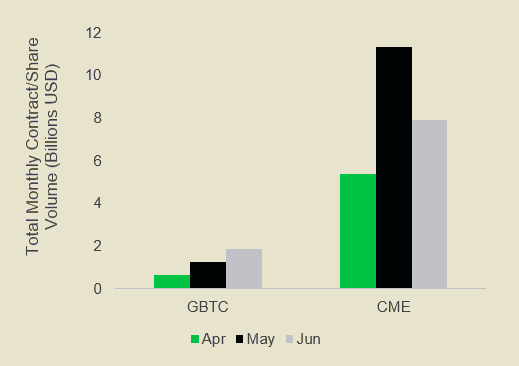

Institutional Trading Products (Derivatives):

As expected, CME (Chicago Mercantile Exchange), the pioneer in launching Bitcoin Futures product continued to dominate the volumes with $11.3 billion USD traded in May. However, June saw a drop of 30% in volume recording $7.9 billion worth of trading (Figure 1).

Despite this trading volume drop, June saw a 30 percent increase in total client sign-ups for Futures product on CME, as reported by Coin Desk. The interest jump from May is still a significant one. The second-largest derivatives product Grayscale’s bitcoin trust product (GBTC) trading volume hit $1.87 billion in June — a 48.1% increase from May. GBTC also showed a consistent increase from April to June.

Crypto & Fiat Capabilities:

The overwhelming majority of trading occurred in Crypto to Crypto pairs recording almost 84% ($493 billion). The proportion remained similar in all three months with May showing the highest activity followed by a slight drop in June (Figure 2).

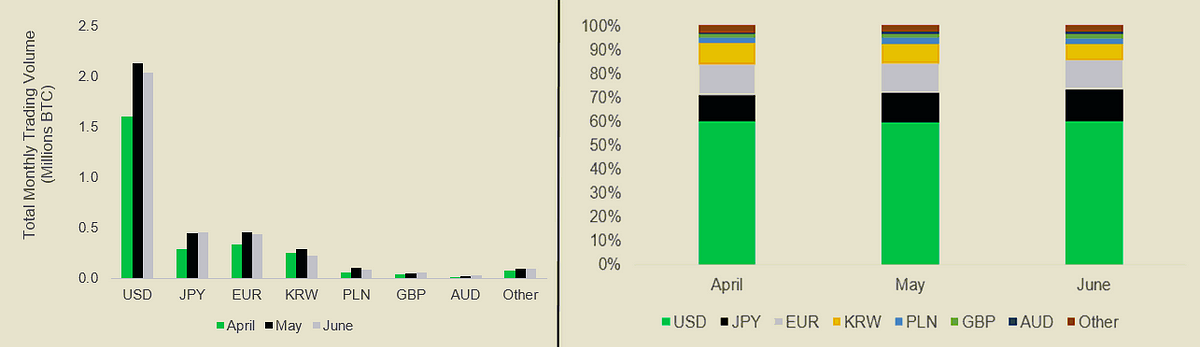

Bitcoin to Fiat Volumes:

US Dollar (USD) is the single largest Fiat currency against whom Bitcoin (BTC) is traded — accounting for almost 60% of the total trading volume (Figure 3). BTC to USD trading showed a slight drop from May to June of -4.3%, dropping from 2.13 million to 2.04 million BTC.

While Japanese Yen (JPY) posted an increase of 1.6% (451K BTC) and Euro (EUR) recorded a decrease of -3.6% (434K BTC) in the same period. The top four fiat currencies of USD, JPY, EUR, and KRW had a share of 92% of the total trading of Bitcoin into fiat currencies.

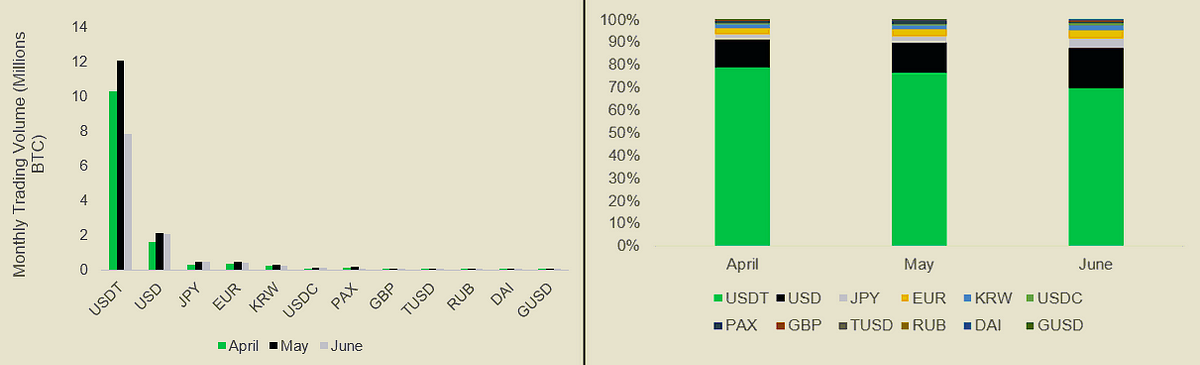

Bitcoin to Stablecoin Volumes:

Just like fiat currencies, the single largest stable coin traded against BTC was Tether (USDT). Despite the share of BTC to USDT falling from 76.2% in May to 69.4% in June (Figure 4-right), Tether is by far the most popular stable coin for BTC trading.

Total BTC trading into USDT fell 34.8% to 7.8 million BTC in June from almost 12 million BTC in May (Figure 4-left). USDT among the other three popular stable coins PAX, USDC, and TUSD accounted for 97.1% of the total Bitcoin trading with stable coins.

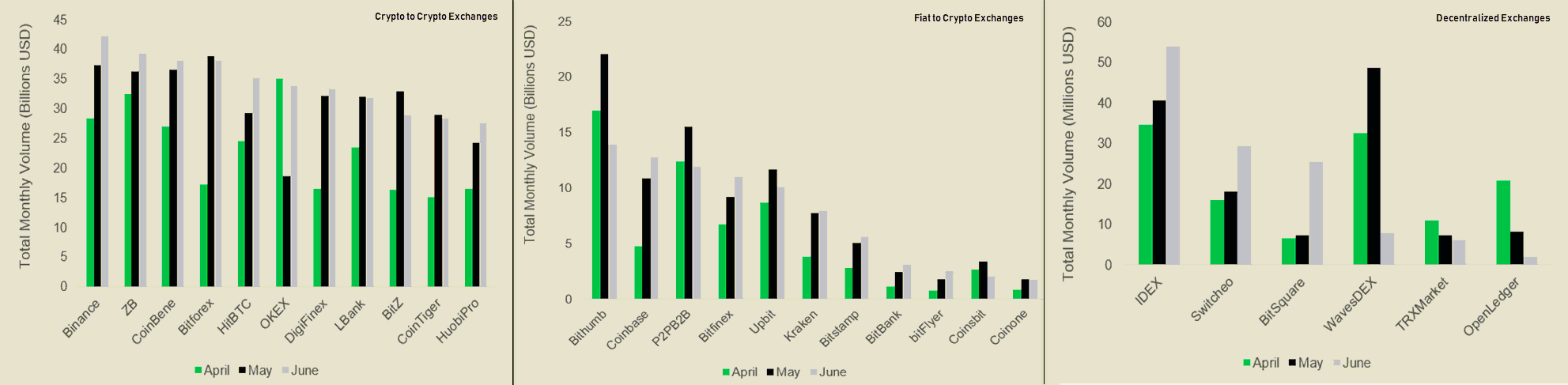

Top Exchanges:

Binance topped as the biggest Crypto to Crypto trading exchange recording an increase of 12.7% with a trading volume of $42.1 billion in June followed by ZB and CoinBene showing an increase of 8.4% and 3.9% respectively in the same period (Figure 5-left). Most of the top exchanges in this segment showed an increase in trading volume from May to June.

Bithumb was similarly the biggest Fiat to Crypto exchange with a trading volume of $13.9 billion in June. Despite a 37% drop in trading volume, it sits comfortably at the top (Figure 5-center). Coinbase is a close second with a $12.7 billion trading volume and a healthy increase of 17.4% from May to June. P2PB2B’s volume came in third at $11.9 billion but with a drop of 22.9% from May to June.

And finally, IDEX was the biggest decentralized exchange with a total trading volume of $53.9 million in June up 33% from May. Switcheo and BitSquare followed with a trading volume of $29.3 million and $25.4 million respectively — up 62% and 249% from the previous month. The DEXs (decentralized exchanges), however, represent only a small percentage of 0.02% of the total Crypto volume trade on all exchanges.

Originally Published on Medium

Email ?| Twitter? | LinkedIn ?| StockTwits ? | Telegram ?

279