Facebook, Chinese Central bank (PBoC) & Binance are vying for dominance in the Stable coin space

As the Crypto gains from earlier this year have faded the price action points towards further weakness. The premiere digital coin Bitcoin continues to slide making lower highs, unable to hold the $11K resistance.

The U.S SEC Chairman Jay Clayton, speaking with CNBC, has reiterated that although progress has been made to address the regulatory concerns over the approval of a Bitcoin ETF, more work still needs to be done. The statement didn’t really move the markets much as multiple delays already seem to be priced in by the markets.

The social media giant Facebook kicked off things earlier this summer with the announcement to launch its stable coin Libra. This has set off a chain reaction with many other big players announcing similar projects. Notable entries include the popular People’s Bank of China (PBoC) & one of the biggest Crypto exchanges along with one of the existing stable coins.

Facebook’s Libra

The entry of the legacy tech giant shook the Cryptoverse. Facebook’s plan to introduce a native digital token came as a pleasant surprise for the Crypto optimists which took it as a sign of wider adoption of the decentralized digital currencies, despite Libra coin being another centralized stable coin pegged to a basket of fiat currencies to be mainly used for cross border payments.

Libra has run into some severe regulatory hurdles in the U.S & around the globe. The regulators are worried on two fronts — one, a platform with a 2.5 billion user following could major disruption to the current monetary system if the digital payment achieves some kind of adoption & second the social media giant has a very shady track record when it comes to protecting personal user information.

As Libra continues to undergo regulatory scrutiny on the U.S Capitol Hill, Bloomberg reports that Facebook has told the Senators that Libra will initially be backed by a basket of these fiat currencies — U.S. Dollar, Euro, Yen, British Pound & Singapore Dollar. The exclusion of Chinese Yuan is a significant move addressing the concerns of the lawmakers who blame China for manipulating its fiat currency. The on-going trade hostilities may have had some part to play as well.

While the Libra Association — the consortium overlooking the project would eventually decide on the addition of any fiat currency, Libra’s team remains determined to get formal approval by abiding by the U.S rules & regulations.

PBoC’s CBDC

Chinese Central Bank — PBoC has been aggressively working on the development of its own digital currency. The process had been given an impetus after fears that Facebook’s Libra was going to bring dominance of the US dollar to the digital world, being pegged to the reserve currency.

PBoC deputy director Mu Changchun has now announced the development of a prototype that adopts blockchain architecture. The new currency is more of an attempt towards digitization & control rather than presenting a challenger to mainstream Cryptos. The vague details that have emerged so far point towards a centralized digital coin.

The central bank has now confirmed that it’s upcoming digital currency would have a similar network design like Libra but will have more of a trust factor since a sovereign centralized institution would be involved in the distribution of the digital currency & gain widespread adoption via payment services like Tencent, Alipay, and WeChat.

In related news, Tether — the biggest stable coin has announced the addition of offshore Chinese Yuan (CNH) & the launch of a new CNH₮ Stablecoin which will run on top of Ethereum blockchain as an ERC-20 token. Unlike the controlled domestic currency (CNY), the offshore Yuan gets traded freely.

Binance’s Venus

The open blockchain project as announced by the top crypto exchange Binance is an initiative to develop localized stable coins and other digital assets pegged to different fiat currencies across the globe. Binance hopes to achieve this by fostering partnerships with governments, corporations, technology companies & other players involved in the blockchain ecosystem.

The Chinese version of the announcement terming Venus as a regional alternative to Facebook’s Libra also got the debate going. While the source of inspiration for PBoC & Binance might be Libra, the move to build a competitor might have different objectives.

Binance, unlike PBoC, is much less concerned with the dominance of Greenback to which Libra is pegged. It is perhaps more worried about a centralized legacy tech giant infringing on the decentralized space of the blockchain ecosystem. A dollar-pegged Libra would, of course, keep the importance of fiat reserve currency alive.

Paxos PAX Gold

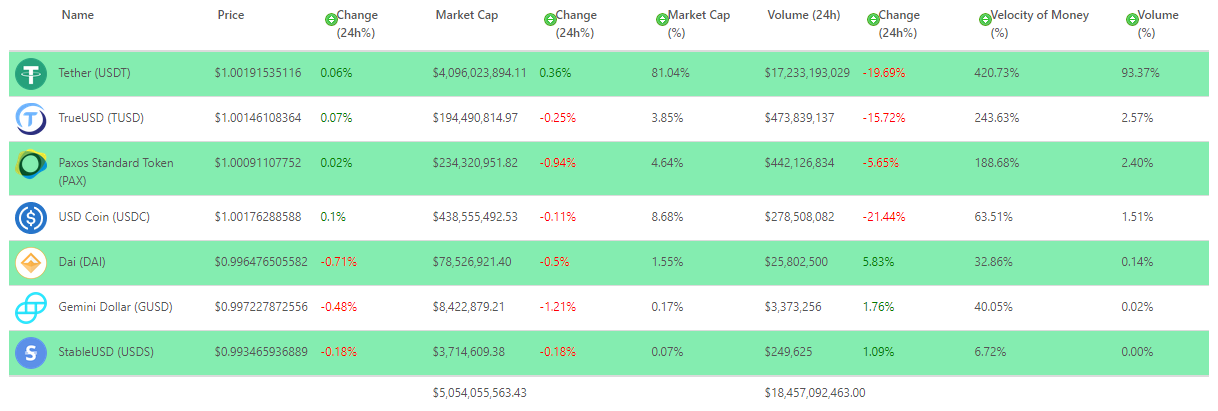

One of the biggest stable coins by traded volume & market cap (figure above) has announced the launch of PAX Gold (PAXG), a gold-backed Ethereum (ETH) token. Although not a direct competitor to the stable coins discussed above, it is a significant move considering its strong backing and that it is being approved by The New York State Department of Financial Services (NYDFS).

PAXG would be redeemable for physical gold — a first in Crypto assets. Each asset-backed stable coin would represent one fine troy ounce of London Good Delivery gold stored in professional vault facilities in London. Customers will have the ability to own the underlying precious metal while having the mobility of a digital asset.

The ERC-20 protocol would enable the digital asset to be easily integrated with exchanges, wallets, lending platforms & other crypto products. You can also avoid the hefty fee of storing physical gold as Paxos charges a negligible fee for on-chain transactions.

Innovation in the Cryptoverse continues to drive the tech movement forward. Looking forward to these & other projects like Xank—an ingenious stable coin project, which offers decentralization, fungibility & a chance to earn a passive income all at the same time.

Originally Published on Medium.

Medium | Twitter | LinkedIn | StockTwits | Telegram

30