5 Charts showing the emerging role of Bitcoin as a hedge in the 21st Century

What a relentless recovery has the Crypto kingpin Bitcoin staged in the past 10 weeks or so as it finally broke the all-important $10K psychological level, last seen in Mar. 2018. Not only that, the FOMO (Fear of missing out) factor that many analysts had predicted might already have kicked in as BTC crossed $11K within less than 24 hours of hitting the psychological level! Whatever the reason for this Power boost — FOMO, Facebook’s Libra or just the good old fashioned hedging of market risks, Bitcoin is poised to climb even higher.

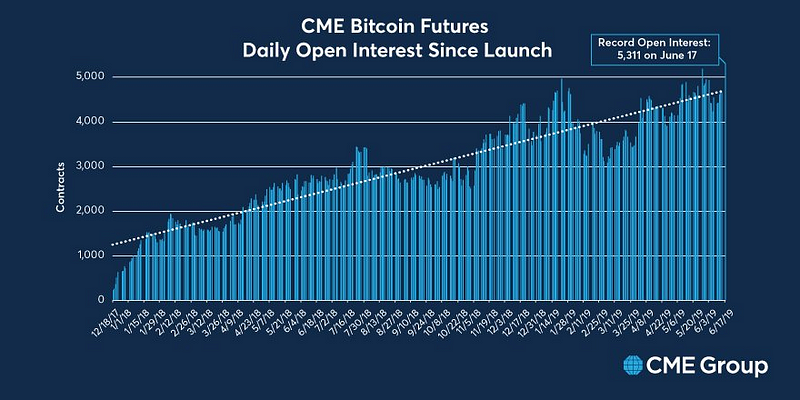

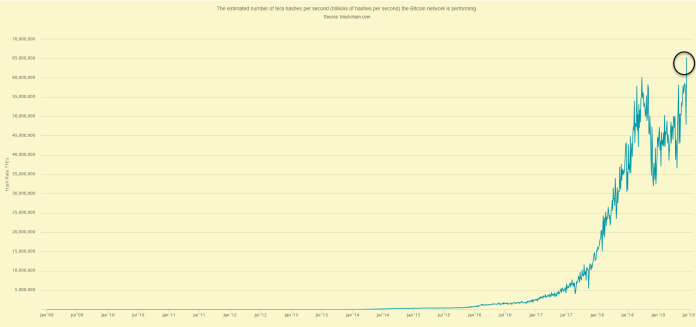

Having said that, the bullish move in Bitcoin & the Alt.coins has a little more solid footing than the last ‘crazy chase’ that we saw to the top in December 2017. Maturing of technology, upgrades around the Bitcoin & Alt. coin networks, bargain prices, better understanding & increased adoption have all combined to shape this bull run. The biggest role has been played by institutional investors who have taken advantage of the bargain prices to accumulate digital assets — volume of BTC on-chain transactions has more than tripled than a year earlier, hash rate has hit an all-time high (65.19 trillion hashes per second — Figure 2), & the CME Bitcoin Futures have also hit a daily open interest high of over 5,000 contracts (Figure 1).

Bitcoin was originally created as a peer-to-peer digital payment system with features of decentralization (neutrality), Borderlessness (publicly controlled) & a limited supply of 21 million coins — all qualities that none of the existing fiat currencies around the World can offer. They are controlled by the central banks, with restrictive monitoring of money & a supply that can be altered at their will. One of the biggest criticism that digital currencies like Bitcoin receive is that it has no physical presence & exists in thin air — however, the reality of the digital age is such that more than 90% of the so-called paper money exists in digital form only, it is no longer a neutral asset since it is controlled by central governments and inflation erodes away the value since you can always print more money. You get my point.

Gold for that matter is a much better store of value than paper money since it is not controlled by any single person, government or identity, has a finite supply and is always and is easily convertible to cash. Gold standard separated the money from the state — the system was so stable that it remained the dominant monetary system for centuries before being abolished about 50 years ago. The precious metal is now a popular mechanism of hedging against market risks. People tend to move their investments to safe haven investments like Gold as I clarified in one of previous articles.

Notice the similarities between Gold & Bitcoin above — the only difference being that while the former has a physical shape, the latter exists in the form of zeroes & ones on your computer. Even that gives Bitcoin a an edge over Gold since it is a challenge to find safe storage for your precious metal holdings, you have multiple ways to store your digital assets (Online, hardware & Paper wallets). Don’t get me wrong, Gold will probably continue to be an important monetary asset, but in an increasingly digital age, Bitcoin will eventually threaten to replace the yellow metal as the ultimate monetary asset. BTC developers are still addressing the Scalability, Privacy & Energy consumption issues — immediate benefits, however, in the form of decentralization, verifiability, portability & divisibility among others outweigh the short term weaknesses.

While Gold is a good hedge against Global Liquidity Risk, Bitcoin is becoming a better hedge. To prove this hypothesis, let’s look at some numbers as presented in the recently published Grayscale Research. To better understand Bitcoin’s emerging role against liquidity risk, the report looks at how Bitcoin has thrived in some of the recent financial crisis which have become frequent in the last few years.

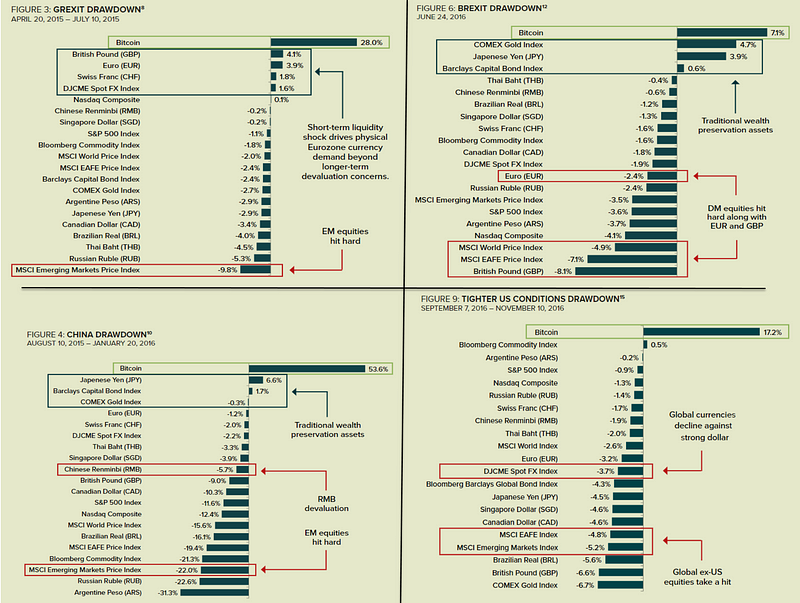

The report identifies five financial drawdown events between 2015–2019, that have shown Bitcoin’s possible positioning as a hedge against Global Liquidity Risks (chart above). Let’s review them:

- Grexit (Apr — Jul. 2015) — The formation of new Government in Greece in Jan. 2015 rang alarm bells of a possible Greek exit from the EU with its prolonged economic troubles in the backdrop. The Greek default became imminent with the new government’s decision to close state banks & the imposition of strict capital controls. However, on Jul. 13, 2015 an agreement was reached between Greece & the international creditors and an economic catastrophe was averted. During this time of an extreme liquidity crunch of centralized assets, Bitcoin became the favored way to transfer assets in & out of the country (Figure 3).

- Economic Slowdown Concerns in China (Aug. 2015 — Dec. 2016) — Chinese Central bank (PBoC), fearing weakness in the World’s second largest economy devalued its local currency Renminbi (RMB) lower by 1.9% pointing to a shift towards more open-market pricing of its currency. Following this single largest one-day drop in more than 20 years & the resulting 5-month sell-off in the risky assets and an RMB devaluation of 11% against the US dollar, investors moved their money into Bitcoin to hedge against the continued devaluation of the Chinese currency (Figure 4).

- Brexit (Jun — Dec. 2016) — UK shocked the World back in June 2016 with its referendum decision to leave the EU. June 24th saw a massive sell-off in risky assets & a sharp decline in value of Pound (GBP) & other currencies against the US Dollar & Japanese Yen, the traditional safe-haven currencies. However, Bitcoin once again was the top-performing asset as other asset classes slipped (Figure 6).

- Geopolitical Risks & U.S Elections (Sep. — Dec. 2016) — The election of a trade-protectionist President in U.S & the talk of policy normalization by the U.S Federal Reserve drove a multi-month sell-off in risky assets which pushed the US Dollar to multi-year highs. While the risky assets began to recover soon after the U.S elections in mid-November, the global currencies continued to depreciate against the Greenback. Bitcoin was once again was the biggest the beneficiary as investors sought to hedge their portfolios from the wider economic risks (Figure 9).

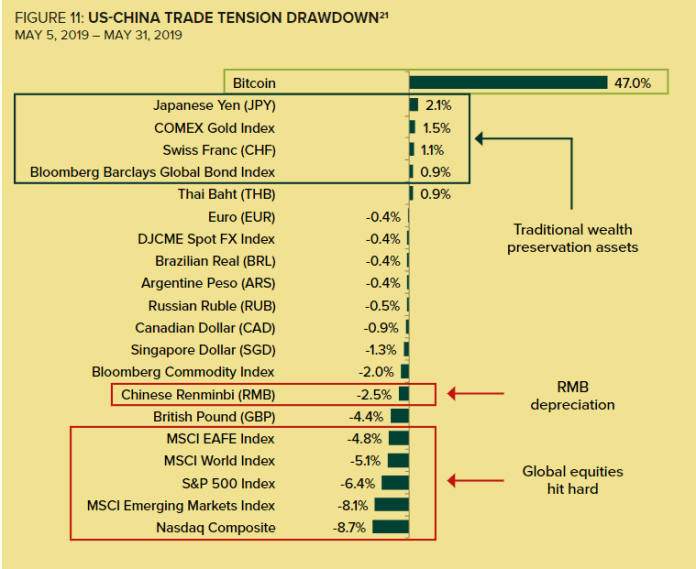

5. Trade Tensions between the U.S — China mount (May 5, 2019 — ?) — Though the back & forth on trade tariffs started back in 2018, the most recent tariff increase by the U.S on $200 billion worth of Chinese imports from 10 to 25%, caught markets by surprise. Given that the two largest economies of the world are embroiled in a tit-for-tat response, it poses a significant risk to the Global economy & market sentiment. Talks are on-going and the issue might still be resolved sooner than later, but Bitcoin has taken off ahead of the risky assets. The percentage gain in BTC from when this recent trade spat started now stands at 93% (current BTC market price), up from the 47% (May. 31) as shown in Figure 11 below.

We are seeing seismic shifts in the economic policies around the Globe (monetary, fiscal & trade) impacting global markets. Market uncertainties, Financial drawdowns & Black Swan events will continue to challenge the complex global financial system. While Bitcoin is still in early days of proving itself to be an investable asset and a hedge against global liquidity crisis, but its response to the recent economic shocks with burgeoning support from institutional investors shows it is well on its way to becoming the Digital Gold.

Originally Published at: www.datadriveninvestor.com

32